Profit is gross margin minus the remaining expenses, aka net income. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, deducting non with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue.

What Are Variable Costs?

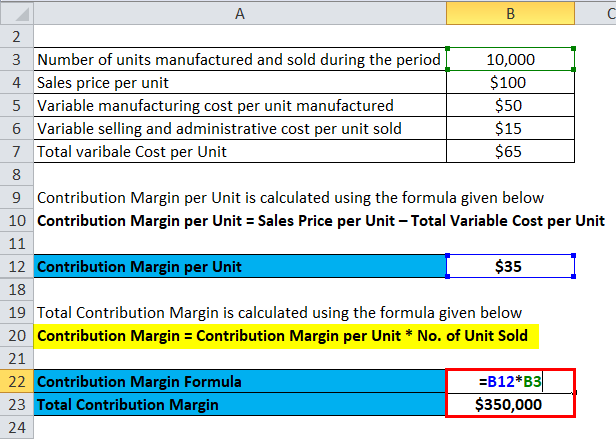

Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. Contribution Margin refers to the amount of money remaining to cover the fixed cost of your business. That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products.

Calculating the Contribution Margin and Ratio

Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period. This is if you need to evaluate your company’s future performance.

- You work it out by dividing your contribution margin by the number of hours worked on any given machine.

- The following are the steps to calculate the contribution margin for your business.

- Thus, you will need to scan the income statement for variable costs and tally the list.

- For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference.

- Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability.

How to Calculate Contribution Margin?

So if after a contribution margin analysis, a company can see that a particular product or service has a margin of $15. This makes it very clear which product to keep and which to get rid of. For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00. Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section.

How confident are you in your long term financial plan?

Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits.

Companies often look at the minimum price at which a product could sell to cover basic, fixed expenses of the business. Fixed expenses do not vary with an increase or decrease in production. They include building rent, property taxes, business insurance, and other costs the company pays, regardless of whether it produces any units of product for sale. This minimum-sale-price analysis is called a break-even analysis. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.

These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. The same will likely happen over time with the cost of creating and using driverless transportation. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company. Net sales are basically total sales less any returns or allowances. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement.

However, the most common use of the contribution margin is to compare products. This is then used to determine which ones should be kept and which ones should be dispensed with. The following examples show how to calculate contribution margin in different ways. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred.

Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. Say a machine for manufacturing ink pens comes at a cost of $10,000.